Table of Contents

- Where's my Refund 2024: Why is the IRS taking so long? These are the ...

- IRS Initiates Tax Return Acceptance Today, Marking the Start of the ...

- Taxes 2024: IRS tax deadline is April 15 to file a tax return or extension

- Tax Day 2024: Here's when the IRS will start accepting tax returns this ...

- 2024 IRS TAX REFUND UPDATE - New Refund Delays, Path Act, Adjusted Tax ...

- Did Your Tax Return Get Accepted Before the IRS Opening Day in 2024? ⋆ ...

- When are taxes due? IRS filings for 2024 begin Monday. What to know.

- Income Tax - CA GuruJi

- Taxes 2024: IRS tax season starts Monday. What to know about refunds ...

- 2024 Tax-Filing Season to Begin on Jan. 29: IRS | NTD

The Internal Revenue Service (IRS) has officially started accepting tax returns for the current tax season. This announcement marks the beginning of a crucial period for individuals and businesses to submit their tax returns and claim their refunds. In this article, we will provide a comprehensive guide on when and how to file your tax return, ensuring you navigate the process smoothly and efficiently.

When to File Your Tax Return

The IRS typically starts accepting tax returns in late January, and this year is no exception. The official start date for accepting tax returns is January 24th. However, it's essential to note that the deadline for filing tax returns is April 18th. It's recommended to file your tax return as early as possible to avoid last-minute rush and potential delays in receiving your refund.

How to File Your Tax Return

There are several ways to file your tax return, and the IRS offers various options to cater to different needs and preferences. Here are a few methods:

- E-Filing: Electronic filing is the most convenient and efficient way to submit your tax return. You can use tax preparation software like TurboTax or H&R Block to e-file your return. This method also allows for faster refunds and reduces the likelihood of errors.

- Mail: If you prefer to file your tax return by mail, make sure to use the correct mailing address and follow the instructions provided by the IRS. This method may take longer to process, and there's a higher risk of errors or lost returns.

- Tax Professional: Hiring a tax professional or accountant can be beneficial if you have complex tax situations or require personalized guidance. They can help you navigate the tax filing process and ensure you're taking advantage of all eligible deductions and credits.

What You Need to File Your Tax Return

To file your tax return, you'll need to gather the necessary documents and information. Here's a checklist to get you started:

- W-2 Forms: Collect your W-2 forms from your employer, which show your income and taxes withheld.

- 1099 Forms: If you're self-employed or have income from freelance work, you'll need to collect your 1099 forms.

- Identification: Make sure you have a valid Social Security number or Individual Taxpayer Identification Number (ITIN).

- Tax Deductions and Credits: Gather receipts and documentation for any tax deductions and credits you're eligible for, such as charitable donations or mortgage interest.

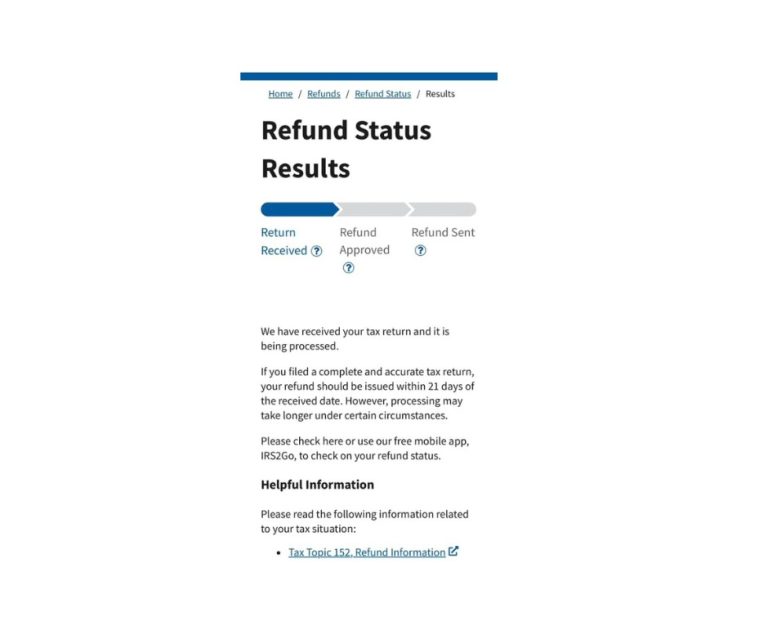

The IRS has started accepting tax returns, and it's essential to file your return as early as possible to avoid delays and ensure you receive your refund promptly. By following the steps outlined in this guide, you'll be well-prepared to navigate the tax filing process. Remember to choose the filing method that best suits your needs, gather all necessary documents, and take advantage of eligible tax deductions and credits. If you're unsure about any aspect of the tax filing process, consider consulting a tax professional for personalized guidance.

Stay ahead of the tax season and file your return with confidence. Visit the IRS website or consult with a tax expert to get started today!